PayPal, established in 1998, is a leading online payments system that supports online money transfers and serves as a digital alternative to traditional paper methods such as checks and money orders. The company was a trailblazer in the online payment space, providing a secure and user-friendly platform that has become integral to e-commerce and financial transactions worldwide.

How PayPal Works

PayPal allows users to make payments, transfer money, and conduct other financial transactions online. It acts as an intermediary between the customer and the merchant, facilitating transactions without requiring users to disclose their financial information to the seller. Here’s a step-by-step look at how PayPal works:

- Account Setup: Users can sign up for a PayPal account using an email address and linking their bank account, credit card, or debit card.

- Making Payments: When a user makes a purchase or transfers money, they can select PayPal as the payment method, which deducts the amount from their linked bank account or card.

- Receiving Payments: Businesses and individuals can receive payments through PayPal, which are then credited to their PayPal account and can be transferred to a linked bank account or used for other online transactions.

Key Features and Services

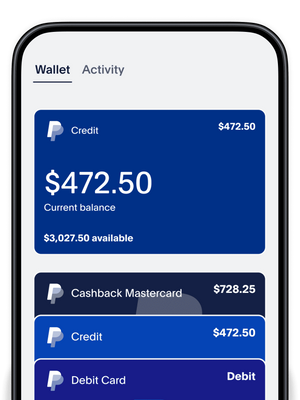

1. Digital Wallet

PayPal’s digital wallet allows users to store and manage their payment methods in one place, facilitating quick and easy online transactions without repeatedly entering card details.

2. Secure Transactions

PayPal provides a secure way to conduct transactions by acting as an intermediary. Users don’t need to share their bank or card details with sellers, reducing the risk of fraud.

3. Global Reach

PayPal supports transactions in multiple currencies and is available in over 200 countries, making it a popular choice for international payments and cross-border e-commerce.

4. Buyer and Seller Protection

PayPal offers protections for both buyers and sellers, including dispute resolution and refunds for unauthorized transactions or items that do not match the seller’s description.

5. Mobile Payments

PayPal’s mobile app allows users to make payments, transfer money, and manage their accounts on the go, enhancing convenience and accessibility.

6. Business Solutions

For businesses, PayPal provides tools for accepting payments online and in-store, invoicing, and managing subscriptions, making it a versatile solution for various business needs.

Advantages of Using PayPal

1. Ease of Use

PayPal’s user-friendly interface and straightforward setup process make it accessible for people of all technological skill levels.

2. Wide Acceptance

Many online retailers and marketplaces accept PayPal, making it a convenient payment option for online shopping.

3. Security and Fraud Prevention

PayPal’s robust security measures, including encryption and fraud detection, provide users with peace of mind when making transactions.

4. Quick Transfers

Users can quickly transfer funds between their PayPal account and their bank account, facilitating faster access to money.

5. Cost-Effective for Businesses

For small businesses, PayPal’s fees are often lower than traditional merchant accounts, and it offers a variety of features that support business growth.

Disadvantages and Challenges

1. Fees for Transactions

While PayPal offers many benefits, it charges fees for certain transactions, such as receiving payments for goods and services, which can be a drawback for some users, particularly those dealing with international payments.

2. Account Holds and Freezes

PayPal has been criticized for its practice of holding or freezing accounts for security reasons, which can disrupt users’ financial activities and business operations.

3. Customer Support Issues

Some users have reported difficulties in resolving issues with PayPal’s customer support, particularly when dealing with account holds or disputed transactions.

PayPal’s Role in E-commerce

1. Facilitating Online Shopping

PayPal has become a standard payment option for online retailers, making it easier for consumers to shop online without the need to enter their payment information for each purchase.

2. Supporting Small Businesses

PayPal’s tools for invoicing, payment processing, and financial management have made it an invaluable resource for small businesses looking to expand their online presence and reach a global audience.

3. Enabling Global Transactions

With its ability to handle multiple currencies and international payments, PayPal has played a significant role in the globalization of e-commerce, allowing businesses to sell to customers around the world.

Conclusion

PayPal has revolutionized the way we conduct financial transactions online, offering a secure, convenient, and widely accepted platform for both individuals and businesses. Despite facing some criticisms and challenges, PayPal remains a dominant force in the online payment industry, continuously evolving to meet the needs of its users in an ever-changing digital landscape.